Poland is a dynamic digital market with over 28 million active social media users (approx. 73% of the population). This makes it one of the largest and fastest-growing social media markets in Central and Eastern Europe. The year 2024 brings new data, changes in user behavior, and the development of tools for businesses. The following report presents key insights into current trends, user preferences, and how companies use social media in Poland – with a perspective useful for international marketing and communication professionals.

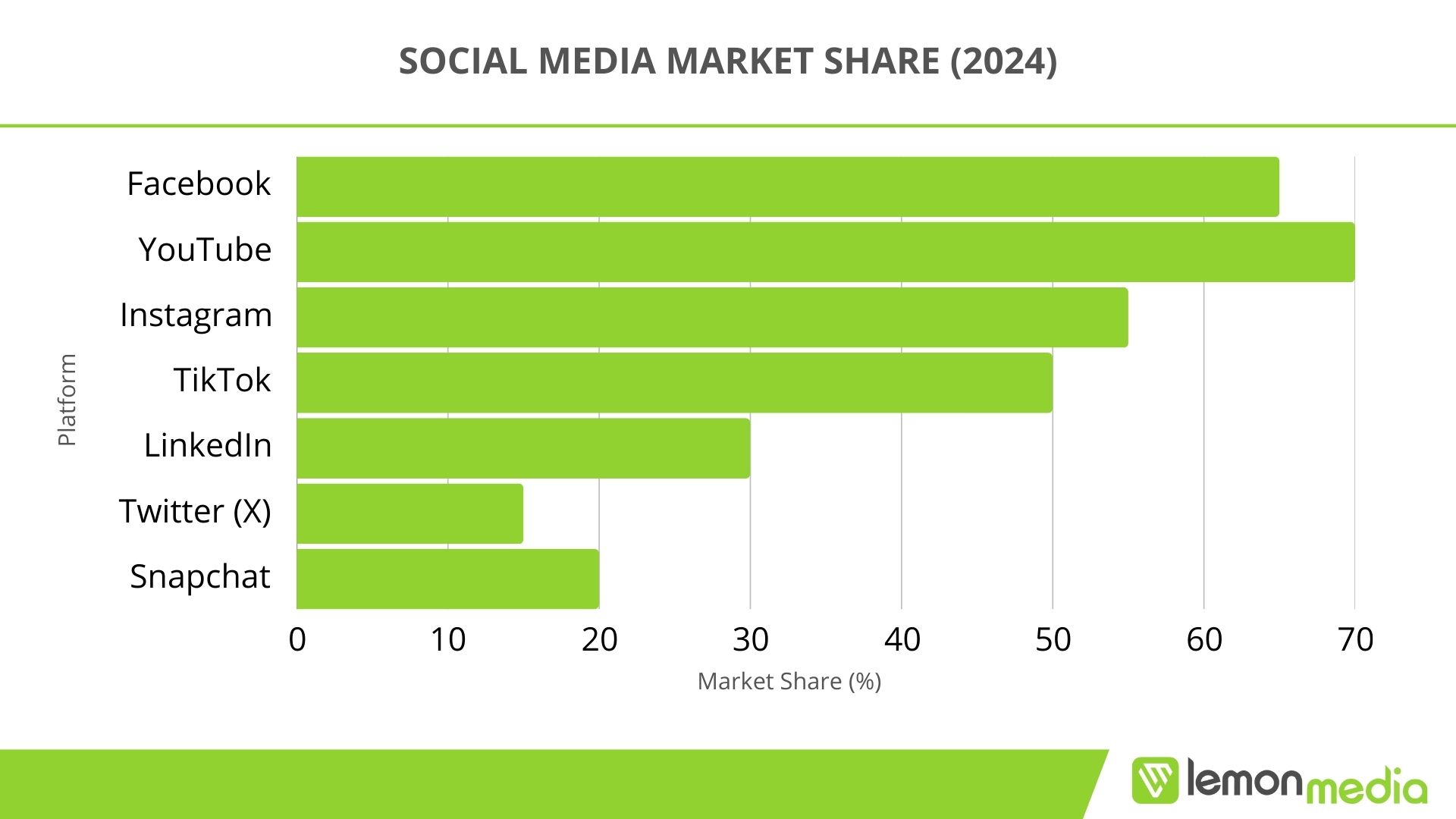

Top Social Media Platforms in Poland:

Facebook – used by approx. 65% of internet users (declining among younger audiences, but still dominant among adults and businesses).

YouTube – approx. 70% (most commonly used for video content consumption, rapid growth of the Shorts format).

Instagram – approx. 55% (rising popularity of Reels and influencer collaborations).

TikTok – approx. 50% (dynamic growth, especially among youth and creative industries).

LinkedIn – approx. 30% (growing among professionals and B2B companies).

Twitter (X) – approx. 10–15% (stable interest, but still a niche platform).

Snapchat – approx. 20% (younger generation, declining popularity).

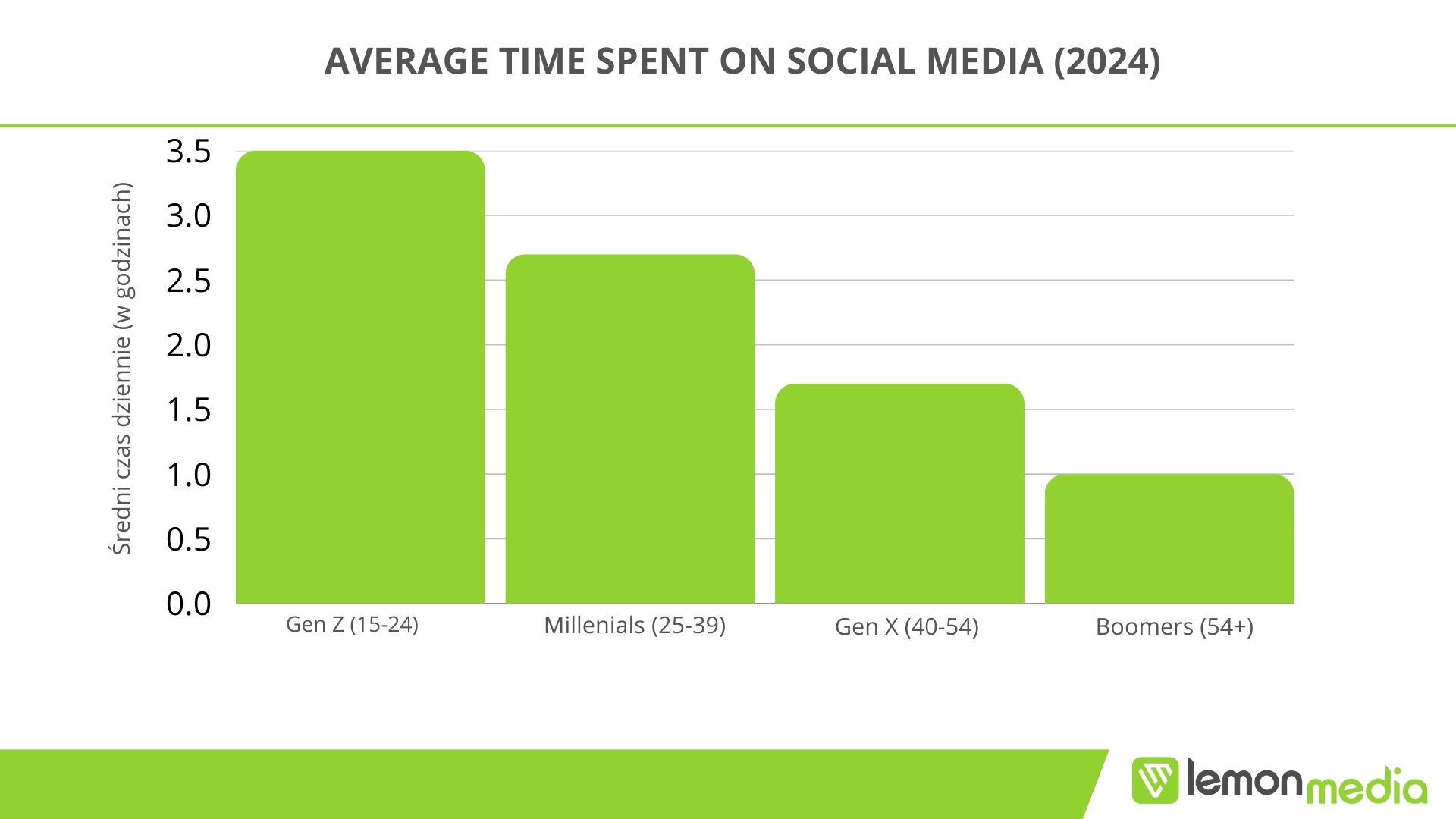

Age-Based Social Media Usage Patterns in 2024:

- Gen Z (15–24 years) – TikTok, Instagram, and Snapchat dominate, with average usage of 3–4 hours per day.

- Millennials (25–39 years) – Instagram, Facebook, YouTube, TikTok, LinkedIn (approx. 2.5–3 hours daily).

- Gen X (40–55 years) – Facebook and YouTube (approx. 1.5–2 hours daily).

- Boomers (55+) – Facebook and YouTube (approx. 1 hour daily).

How Industries Use Social Media in Poland (2024)

In 2024, over 90% of companies operating in the Polish market are actively engaged in social media, treating it as a key channel for communication, marketing, and sales. Social media presence has become the norm – in both B2C and B2B sectors – and the choice of platforms is closely tied to the industry, target audience, and campaign objectives.

Facebook – the most widely used platform by companies in Poland, regardless of business size.

- Acts as a customer service channel (Messenger, comments), especially in e-commerce and local services.

- A hub for promoting offers, events, and seasonal advertising campaigns (retail, FMCG).

- Effective for remarketing campaigns thanks to advanced targeting capabilities.

- Still a key channel for brands targeting the 30+ demographic.

Instagram – a must-have tool for creative industry brand strategies.

- Main platform for visual industries: fashion, beauty, gastronomy, interior design, travel.

- Supports brand image building through aesthetic content, stories, and videos (Reels).

- Actively used in influencer campaigns – both reach-based and conversion-driven.

- Growing importance of shopping features (Instagram Shopping, product tagging).

LinkedIn – the leading platform for B2B and employer branding efforts.

- Essential for tech, consulting, recruitment, and corporate firms.

- Used to build expert reputation, generate leads, communicate with partners, and promote industry events.

- Increasingly used in HR and EB campaigns, especially for attracting talent in IT, finance, and engineering sectors.

- Companies not only create branded content but also encourage employees to act as brand ambassadors.

TikTok – rapidly growing importance as a marketing tool.

The role of niche creators (nano- and micro-influencers) is growing as carriers of authenticity and product recommendations.

Brand presence on TikTok is no longer experimental – it is now a fully-fledged communication channel for targeting younger demographics.

Content must match the platform’s format and tone: authenticity, creativity, and humor matter more than polished production.

Brands use TikTok for organic reach and paid campaigns – particularly in e-commerce, beauty, gastronomy, and informal education sectors.

Twitter (X) in Poland – Who Uses It?

Despite global changes following Elon Musk’s takeover, Twitter (now X) remains a niche platform in Poland – with approx. 10–15% of internet users actively using it. Its role is clearly defined within certain communities. Journalists, politicians, and commentators show the highest engagement, using X as a tool for real-time exchange of news and opinions.

In the entertainment space, gaming and e-sports communities use Twitter to comment on events, premieres, and engage with creators. Brands present on X treat it mainly as a supplementary channel – useful for PR efforts, media monitoring, and responding to mentions. Its limited reach in Poland reduces its effectiveness for large-scale sales or awareness campaigns.

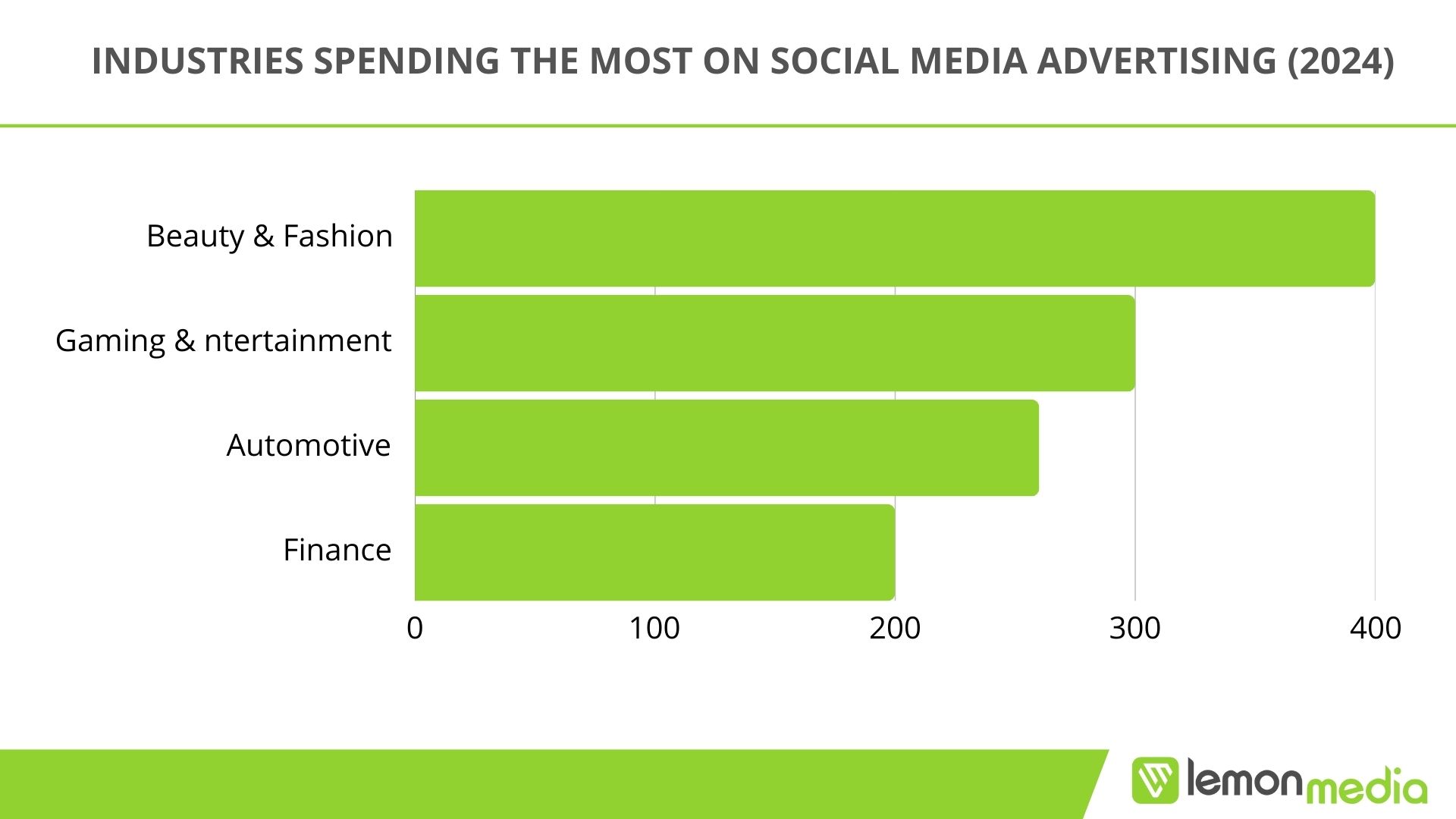

Social Media Advertising Spend – Leading Sectors

In 2024, estimated social media advertising spend in Poland exceeded PLN 2 billion. These investments continue to grow steadily, and social media has become not just a branding tool, but a key driver of sales. The most active industries run integrated campaigns leveraging paid promotion, influencer marketing, and video content.

The financial sector invests in educational content campaigns targeting specific audiences on Facebook and LinkedIn. The rise of fintech and online services increases the focus on personalized messaging, trust-building, and long-term brand presence.

The beauty and fashion industries primarily invest in influencer partnerships and native content that fits the visual style of platforms like Instagram and TikTok. For these brands, social media is not just an inspirational space, but also a direct source of conversion, supported by shopping features and user reviews.

The gaming and entertainment sector concentrates budgets on YouTube, TikTok, and Twitch. Main activities include premiere promotions, streamer partnerships, and campaigns built around online/offline events. Content is immersive, dynamic, and community-driven.

The automotive industry focuses campaigns on brand awareness and lead generation. High-quality videos on Facebook and YouTube, along with interactive formats, are often linked to local showrooms and dealerships.

Market Potential and Key Takeaways for International Companies

The Polish social media market is now one of the most mature digital ecosystems in Central and Eastern Europe.

With over 27 million active internet users (over 70% of the population) and about 26 million social media users (source: DataReportal 2024), the growth of the e-commerce sector – which surpassed PLN 130 billion in value in 2023 (source: PwC) – aligns with the increasing role of online channels in purchase decisions. Additionally, rising digital advertising spend – which exceeded PLN 7.2 billion in 2023, with over half allocated to social media campaigns (source: IAB Poland) – and the strong presence of global platforms (Facebook, Instagram, YouTube, TikTok) make Poland an extremely attractive market for foreign brands, particularly in the direct-to-consumer (D2C) model.

Companies planning to enter the Polish market should consider local consumer behavior, generational differences in platform usage, and strong competition in sectors like fashion, beauty, electronics, and FMCG. Campaigns in the Polish language, collaboration with local content creators, the right channel mix, and a flexible approach to changing trends are essential.

For brands already active in Western Europe, Poland offers a natural digital expansion opportunity – in terms of both reach and campaign cost-effectiveness.

Social Media in Poland: Data, Directions, Recommendations

The year 2024 reaffirmed the strategic importance of social media for businesses operating in Poland. Over 90% of companies actively use social media for communication, sales, and relationship building. Their role has increased significantly with the continued rise of online sales – the e-commerce sector grew by 3.8% year-over-year in 2024, directly translating into intensified advertising and content activity on social platforms.

Today, social media is not just a branding tool, but a genuine channel for revenue generation, talent acquisition, and customer loyalty. Companies – both local and international – should continue focusing on three core areas:

Building micro-communities and trust through authentic content and collaboration with smaller creators.

Monitoring changes in user behavior and generational preferences.

Scaling the use of AI-based tools and video formats in digital strategies.

The growing importance of e-commerce and rapid development of digital tools show that companies able to quickly adapt to the evolving social media environment will gain a competitive edge in the Polish market.